Transparency is Making Customers Trust You Less—Here’s Why.

DCX Links | January 25, 2026

Welcome to the DCX weekly roundup of customer experience insights!

AI is changing customer experience fast—and not always in the ways teams expect.

Video used to feel like proof. Now it’s not.

Telling customers “we use AI” sounds good, until it actually makes them trust you less.

And self-service only works if agents actually point people to it.

The big shift this week is simple: customers expect more, and they’re less patient. They know AI is involved. What they care about is whether it helps them solve their problem faster, explains what’s happening in plain language, and doesn’t make a stressful moment worse—especially with things like claims, fraud, or returns.

The teams doing this well aren’t chasing buzzwords. They’re fixing the basics. They show progress, not process. They connect systems so customers don’t have to repeat themselves. They design AI like part of the experience, not a bolt-on feature.

Bottom line: AI didn’t make CX harder. It made weak experiences easier to spot.

Let’s dig in!

This week’s must-read links:

The AI Artist Proving Taste Still Matters

When “Video Proof” Stops Being Proof

Insurance CX in 2026. More Claims, Less Patience

AI Transparency Can Backfire. Here’s How to Not Screw it Up.

DCX Stat of the Week: Your Agents May Be Quietly Killing Self-Service

DCX Case Study of the Week: Genesys Boosts Support CX with AI-Driven Experience Orchestration

The AI Artist Proving Taste Still Matters

If you think AI visuals are just prompts doing backflips, Kelly Boesch is here to politely ruin that take. Her work feels deliberate. Cinematic. Designed by someone who knows what they’re doing. Because she does.

Why it matters:

Kelly didn’t wake up viral. She spent ~17 years in film and creative work, including a long run at IMAX, learning how scale, motion, and emotion actually work.

That experience shows. These visuals aren’t static flexes. They move with intent and hold attention longer than a scroll-second.

What’s happening:

She’s built a serious footprint. Over 1.5M followers and around 60M monthly views across Instagram, TikTok, and YouTube.

The work blends abstract art instincts with cinematic AI loops. People call it dreamlike because it’s engineered to feel that way.

Between the lines:

Kelly treats AI like a creative partner, not a shortcut. She’ll sketch ideas in Midjourney, animate in tools like Runway, then layer music to match the mood.

Her visuals have made the jump from feeds to physical spaces, including venues like Hï Ibiza. That’s not common.

The takeaway: AI didn’t replace the artist here. It finally met one.

🔗 Go Deeper: Kelly Boesch

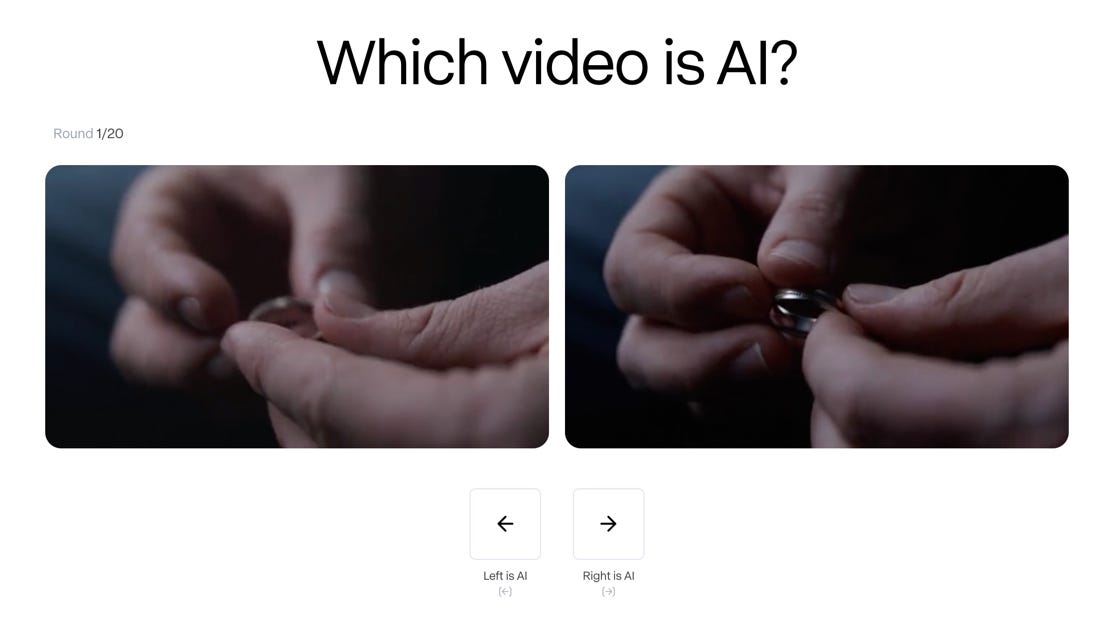

When “Video Proof” Stops Being Proof

If your fraud team, claims team, or social team still treats video as the ultimate receipt, Runway just tossed that assumption into the shredder. In a new “Real or AI?” test, most people basically guessed.

Why it matters:

Runway recruited 1,043 participants. Only 9.5% performed above a statistical threshold for accurate detection (15/20).

Overall accuracy was 57.1%. That’s barely better than flipping a coin, which is the whole problem.

Reality check for CX:

“Send us a video” becomes a risky step in dispute resolution, returns, delivery claims, and even identity checks.

Humans were a bit better at spotting human footage. Animals and architecture fooled people more often than not.

What to do Monday morning:

Treat detection as a backstop, not a strategy. Build provenance into the journey (capture source, chain-of-custody, metadata checks).

🔗 Go Deeper: Runway

🔗 Which Video is AI? Try it yourself

Insurance CX in 2026. More Claims, Less Patience

When customers call their insurer, it’s already a bad day. In 2026, there are just more of those days. More storms, more claims, more anxiety, and a lot more “what’s going on with my claim?” moments. This piece lays out what’s changing and why insurers can’t treat communication like an afterthought anymore.

Why it matters:

Losses keep stacking up. Swiss Re Institute projects insured catastrophe losses around $146B, which means longer claim cycles and more stressed customers.

Clear communication isn’t a nice-to-have. J.D. Power found satisfaction nearly doubles when insurers make interactions simple and easy to follow.

What’s happening:

Messages are exploding. IDC reports customer communications are up 18%, and claims volume only adds fuel.

Legacy tech is finally getting called out. Gartner says 63% of insurance leaders are modernizing core systems to remove friction customers feel every day.

Between the lines:

AI is moving insurers from sending updates to having conversations. Customers now expect faster answers that actually reflect their situation.

This is why platforms like OpenText and Guidewire matter. CX breaks when systems don’t talk.

The CX To-Do: Read your last five claim emails. If they explain process instead of progress, that’s your problem.

🔗 Go Deeper: Opentext

AI Transparency Can Backfire. Here’s How to Not Screw it Up.

Everyone says “be transparent about AI.” Then they either hide it in a footer or dump a novella on the customer. Same outcome. Less trust. This HBR piece explains why the middle ground is harder. And more important.

Why it matters:

Trust isn’t a single lever. Deloitte measures it across transparency, humanity, capability, and reliability. Push one too hard and you expose the others.

Explaining AI clearly makes customers feel respected and informed. It does not automatically convince them the system actually works.

What’s happening:

Autodesk tested “AI Transparency Cards.” Think nutrition labels for AI features.

Results were telling. Transparency jumped 26%. Reliability rose 13%. Capability and humanity dipped. Customers understood more and then raised the bar.

Between the lines:

Transparency changes expectations. Once customers know how the AI works, they want proof it delivers and doesn’t treat them like data exhaust.

Different audiences want different depth. Engineers want detail. Frontline users want impact. Gen Z trusts peers before policy pages.

The CX To-Do: Design AI explanations like product UX. Progressive disclosure, plain language, optional depth. Keep updating it as the model evolves.

🔗 Go Deeper: HBR.org

DCX Stat of the Week

Your Agents May Be Quietly Killing Self-Service

DCX Stat: A Gartner survey of 5,801 customers found that 60% of customer service agents fail to promote self-service options during interactions.

Takeaway: If you’re investing in portals, bots, or help centers, your frontline may be undermining adoption. CX leaders should treat “agent promotion of self-service” as a core KPI—supported by scripts, training, and incentives—not a nice-to-have.

🔗 Source: Gartner

🔗 MORE STATS: Daily Stats on Substack Notes

DCX Case Study of the Week

Genesys Boosts Support CX with AI-Driven Experience Orchestration

CX Challenge: The Genesys product support team needed to scale customer support, improve efficiency, and deliver better experiences across channels while managing growing demand and complexity.

Action Taken: Genesys deployed its own Genesys Cloud CX® platform with AI-powered virtual agents, agent copilot tools, automated routing, and experience orchestration. These technologies streamlined workflows, shifted interaction patterns, and reduced friction in support touchpoints.

Result:

📈 20-point increase in customer experience scores

💬 35% of interactions shifted to chat, reducing strain on voice channels

📉 34% reduction in routing time

⏱️ ~5 minutes saved per support call

🚀 9.8X ROI equivalent and 157,000+ cumulative hours saved

📉 43% reduction in case escalations

👩💼 >90% increase in employee development time with attrition <3%

Lesson for CX Pros: Leveraging AI-powered orchestration and automation not only accelerates operational efficiency, it can drive significant customer satisfaction gains and free up teams for higher-value work. Aligning CX technology with employee enablement creates a compounding effect: better experiences for customers and employees.

Quote: “Customer experience is our DNA. It’s more than the solution we offer; it’s making sure we orchestrate a world-class experience for our customers,” said Dominic LoBosco, SVP of Customer Support at Genesys.

🔗 Further Reading: Genesys

Got a CX win worth sharing? I’m all ears 👂

Thank you!

If this edition sparked ideas, share it with a colleague or team member. Let’s grow the DCX community together!

✉️ Join 1,480+ CX leaders who stay ahead of the next customer curve.

Human-centered insights. Plug-and-play frameworks. Smart tools that actually work.

All designed for CX pros who want to build with purpose—and deliver with impact.

👉 Subscribe today and get the tools to elevate your strategy (and your sanity).

Really appreciate the Runway study highlight here. The 57% detection rate is honestly terrifying for anyone still relying on video in fraud prevention. We recently overhauled our claims verification process at work becuase of exactly this issue. The move toward provenance tracking and metadata checks makes way more sense than playing the detect-or-not game. Customers dunno whats AI generated anymore and frankly neither do we.